My grandmother lived in a lovely continuing care retirement community that she chose herself. The only problem? She was surrounded by old people, she complained. But who could blame her? Back in her old neighborhood, she enjoyed having the little boy next door over for cookies. Her new community lacked that energy and diversity. This week, Money launched our Best Places to Live 2020, and diversity was one of the data points we weighed in our analysis. Not all of the factors, such as job growth, touch retirees directly. But they do influence the mix of people that a community attracts, which in turn makes it a desirable place to live. Learn about this year's winner in today's edition.

Best wishes, Elizabeth

TIMELY RETIREMENT NEWS, INSIGHTS, AND ADVICE

RETIRE WITH MONEY COMMUNITY INSIGHTS

This week in our Retire with Money Facebook group, a member flagged this report showing that the average household cable package in the U.S. costs $217.42 a month. That's a hefty amount, and about what my family was spending before we cut the cord a little over a year ago. Now, we spend about half of that on various streaming services. We're saving more than $1,000 a year, and the only thing we miss even a little from our fancy cable package are the multiple sports channels that my son watched on occasion.

WHAT WILL MY SAVINGS COVER IN RETIREMENT?

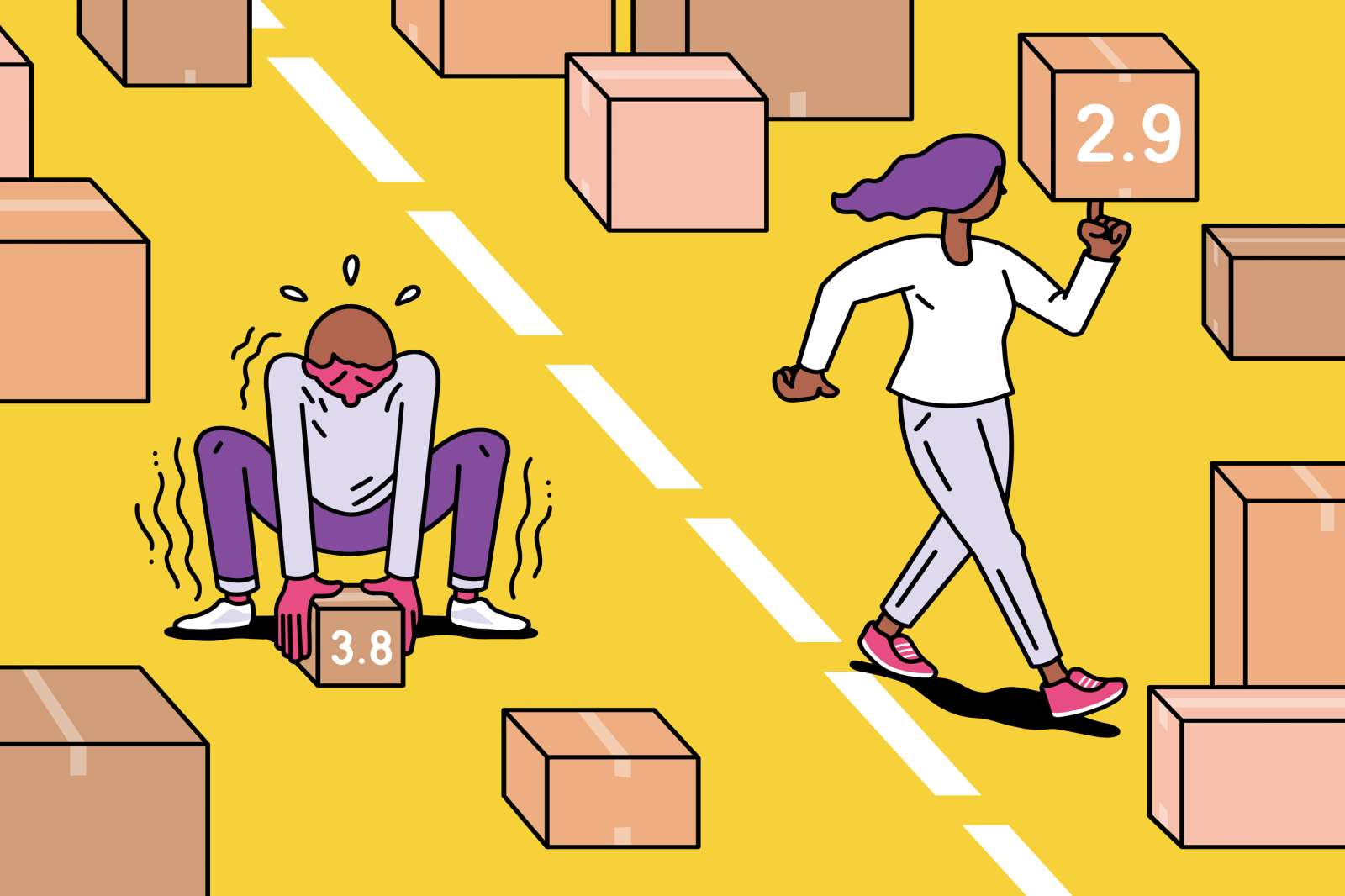

Planning for retirement can be tricky; after all, there's no way of knowing for sure how much money you may need. You can start by estimating how much you may spend each year in retirement. You probably won't spend as much each year in retirement as you do during your working years, so you'll only need to replace part of your income in order to maintain your lifestyle in retirement. As a general rule of thumb, you can estimate that your savings (including a pension, if you have one) should provide a yearly income equal to about half of your pretax, preretirement income. Your Social Security benefits may cover the rest of your annual retirement expenses, but it depends on your spending and lifestyle. The age at which you claim Social Security benefits can have a significant impact on your monthly income too. Click below to see if you are saving enough for retirement. Investing involves risk, including risk of loss.

RETIREMENT NEWS FROM AROUND THE WEB

Americans Are Raiding Retirement Savings During Coronavirus Pandemic

Around 30% of savers tapped their account, according to one survey. CNBC

Can't Go to the Gym? Here Are Some Good Home Workouts

AARP tapped Bryant Johnson, trainer to the late Ruth Bader Ginsburg, and other experts to lead these 10-minute workout videos. AARP

Opinion: Americans' Love Affair With Pickup Trucks Might Derailing Their Retirement Plans

An $800 monthly car payment? Many would be better off putting that money toward their retirement account. MARKETWATCH

Elizabeth O'Brien is deputy editor at Money. She has covered retirement and health care for nearly a decade. A Brooklyn resident and mom of two boys, she navigates the alphabet soup of Medicare and the New York City subway system with equal ease. You can email her at elizabeth.obrien@money.com and follow her on Twitter at @elizobrien.

|

How to tell if you're getting the best mortgage rate.

Comentarios

Publicar un comentario